Biden Administration Uses BLM and US Forestry Services to Implement New Tax Scheme—Starting with Private Land Owners, Farmers and Ranchers!!!

Breeauna Sagdal–Senior Writer and Research Fellow at The Beef Initiative

Posted on X

Biden Administration Uses BLM and US Forestry Services to Implement New Tax Scheme—Starting with Private Land Owners, Farmers and Ranchers!!!

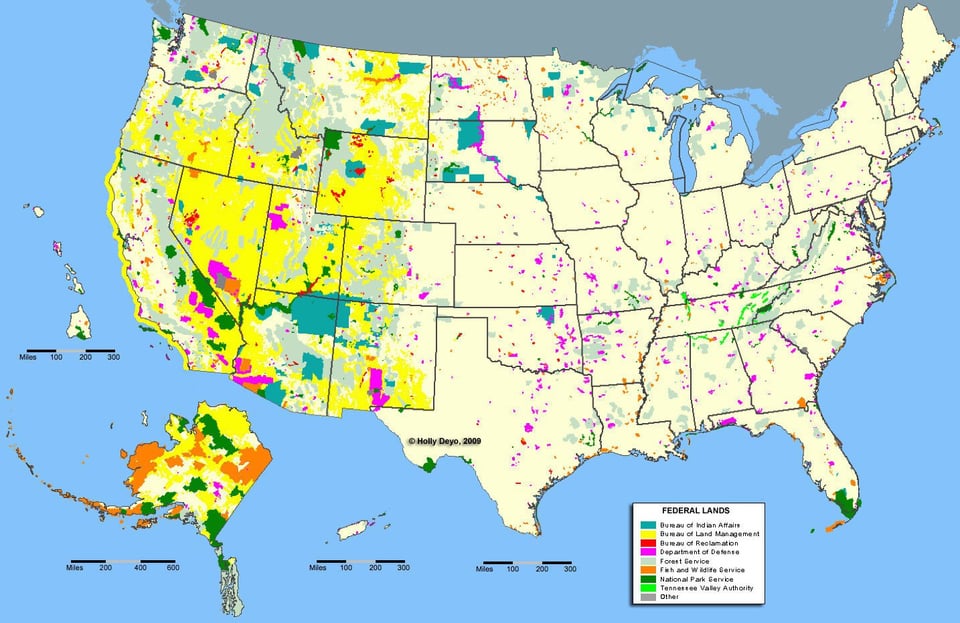

Recent rule changes through the Forestry Service aim to onboard farmers and ranchers into the “voluntary” carbon market—buying carbon as a commodity. However, the administration has also leveraged access to private property through increased buffer zones, land use regulations, and wildlife corridors, which prevent private land owners from accessing their own lands. The new tax scam administered through the Commodity Credit Corporation is currently “voluntary” but the purchase of carbon credits appears to be a determinant of liquidity access, and how/where land use regulations are applied. AKA “voluntary” fee for the right to access your own property. Ironically, private ranchers and forestry owners have been the only reason that wildfires have been mitigated over the last five years.

Without private stewardship, these lands will go up in flames, causing more carbon emissions in hours than entire cities emit per year. In addition, private landowners are the first to reseed, and the first to help breed back wildlife lost to fires—as recently seen following the Texas panhandle fires. “USDA is preparing to establish the Greenhouse Gas Technical Assistance Provider and Third-Party Verifier Program (the Program), authorized under the provisions of the Growing Climate Solutions Act (GCSA), which was signed into law on December 29, 2022, as part of the Consolidated Appropriations Act of 2023 (Pub. L. 117-328, div. HH, title I, section 201).

The purpose of the Program is to facilitate farmer, rancher, and private forest landowner participation in voluntary carbon markets.” Not only is this an unfunded mandate used to force compliance, this structure will guide the future of carbon taxes for the general population in years to come. Take question (f) for example: “(f) Does the registry administering the protocol use a fee structure that allows for aggregated entities to pay a single project fee, or does each entity need to pay a project fee?” If we have to pay per acre to plant or graze, per season on our OWN property, your food costs will skyrocket and it’s only a matter of time before you’re being charged per mile, per trip, to drive your own car. Or, charged per grocery trip, per doctors visit, per garment, etc.

This is a new tax scheme, plain and simple.

federalregister.gov/documents/2024