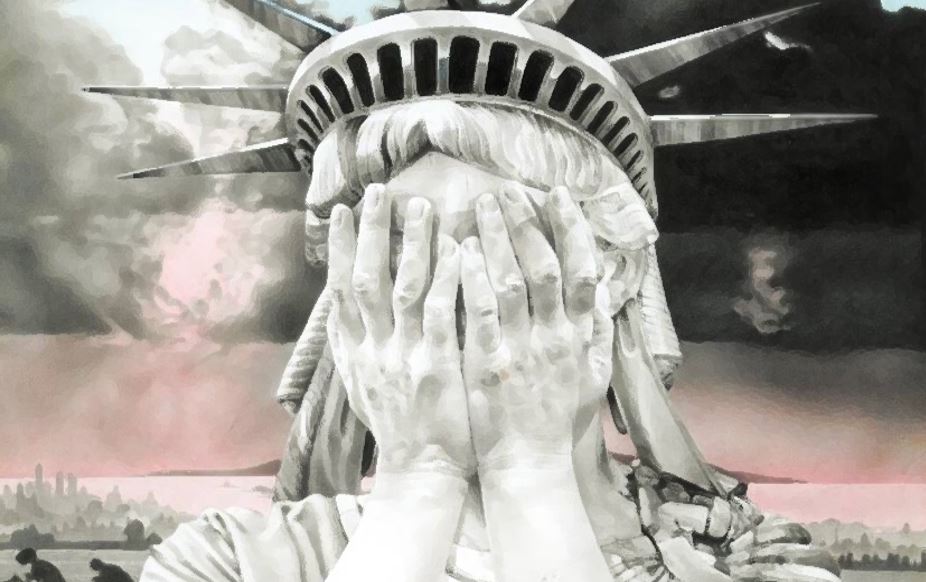

S&P Hits U.S. States With Politicized Credit Scores

The ratings agency seeks to penalize fossil-fuel producers. Its ‘ESG’ push is unlikely to end there.

by Utah Treasurer, Marlo Oaks

Ideological criteria will now influence the credit ratings of state and local governments, thanks to S&P Global Ratings. In addition to rating governments on meaningful financial criteria, in March the biggest of the top three credit-rating firms began to apply an environmental, social and governance, or ESG, rating system. But Utah isn’t about to submit to these subjective standards. State officials, including myself, recently wrote a letter to S&P objecting to the ESG indicators and ratings it has assigned to Utah and calling for the company to withdraw them.

ESG is sometimes dressed up to look objective with quantitative “metrics” and complex “analytical frameworks.” But this blurs the distinction between subjective judgments and objective financial assessments.

S&P Global says it “incorporates [ESG] risks and opportunities into the credit rating analysis” of public issuers. This includes ambiguous and open-ended categories such as how a state scores on “managing carbon,” “political unrest stemming from community and social issues” and “adverse publicity that results in reputation risk.” Leaving no doubt as to the measurement’s subjectivity, S&P notes, “reflecting ESG risks and opportunities within our credit rating analysis will require a qualitative view of an entity’s capacity to anticipate and plan for a variety of emerging risks.” Unlike quantifiable financial metrics, this qualitative view depends entirely on the beliefs of whoever constructs it.

It’s easy to see that those beliefs are left-wing. S&P assigns a lower ESG score to states that have both “physical risks” like earthquakes and natural disasters and a larger percentage of their economy tied to natural resource extraction, such as Texas, Alaska and Louisiana. S&P’s Environmental category, after noting federal-state partnerships’ financial mitigation of natural disasters, focuses its assessment on the costs of making the transition to “net zero” and the policy changes it predicts will be necessary to “curtail” greenhouse-gas emissions.

Certainly, if a state’s finances are overly concentrated on any one particular industry this will affect its financial outlook because of the risk that revenue could decline should that industry’s fortunes contract. But a traditional credit rating takes into account the diversity of industry in a state already, so why create an ESG metric that could be politicized? Instead of focusing on the financial risk associated with economic concentration, the ESG metric highlights if a state or local government allows what S&P thinks is too much oil, gas or coal extraction.

Further, there are national security, economic and even environmental benefits for U.S. states to produce traditional energy. Many countries are searching for sources of natural gas and oil so they can lower their dependence on Russia after its invasion of Ukraine. In that environment, states like Texas, Alaska and Louisiana have a tremendous market advantage and could see improved cash flows. Not only are their fossil fuel revenues benefiting a free democracy, Russia’s natural gas exports to Europe burn 41% dirtier than American natural gas. Exporting U.S. natural gas would create a significant environmental benefit. Authoritarian regimes like Russia threaten, among other things, the environment, human rights, free societies and democratic government—all factors that should be important to ESG proponents. That S&P’s ESG metrics completely ignored or missed these variables exposes some of the major flaws of ESG ratings. Such scores place a value judgment on political issues that do not have one right or wrong answer, are highly complex, and are impossible to predict.

As the Russian situation has shown, ESG assessments depend on variables that can change rapidly. Before Russia attacked Ukraine, Europe was moving away from fossil fuels and military spending. That changed almost overnight. This is why markets are so valuable; they encapsulate many different views of the future and their organic structure allows for quick adaptation. ESG scores, by contrast, rigidly hold to one viewpoint and are slow to pick up on changes in the world. The minds behind S&P’s ESG metrics seem to believe that a transition to green energy is inevitable and therefore punish states that produce traditional energy for “climate transition risk.” But no one really knows what this “climate transition” will look like. There are no widely accepted, economically viable alternatives to fossil fuels in the market. No one knows where they’ll come from, what they’ll be or when they’ll arrive.

ESG metrics’ false certainty about future events, and consequent inability to keep up with unanticipated current events, causes capital to be misallocated. They create bubbles in favored industries while starving others that could be profitable.

The solutions to our most difficult challenges—such as climate change—can come only through innovation. Foisting rigid ESG factors onto the market discourages innovation by mandating conformity, penalizing creativity and punishing the industry with the greatest incentive to find alternatives—the energy sector. Fracking has reduced U.S. carbon emissions immensely, but it could cost you under S&P’s ESG metrics.

Utah has prudently managed its finances over decades and as a result maintains the highest possible credit rating from all major firms, allowing the state to borrow money at the lowest rates and save taxpayer dollars. But under the new ESG regime, those financial factors may be supplanted by subjective, political ones.

These metrics also threaten Utah and other states’ democratic sovereignty. The ESG disclosures many corporations have felt compelled to release have also led to frivolous legal action and shareholder resolutions, an additional fiscal drag on businesses. Extending this regime into the municipal sphere is an invitation to litigation and other coercive tactics that will sabotage states’ self-determination and independence.

States like Utah value our constitutional republic, which has ensured freedom, and free markets, which have fostered innovation and generated prosperity for generations. Any states, governmental jurisdictions, corporations, individuals, and investors who also hold those beliefs should join us in standing against ESG.

Mr. Oaks is treasurer of Utah.

1 thought on “S&P imposes Communist Chinese-style “social credit” system on states”